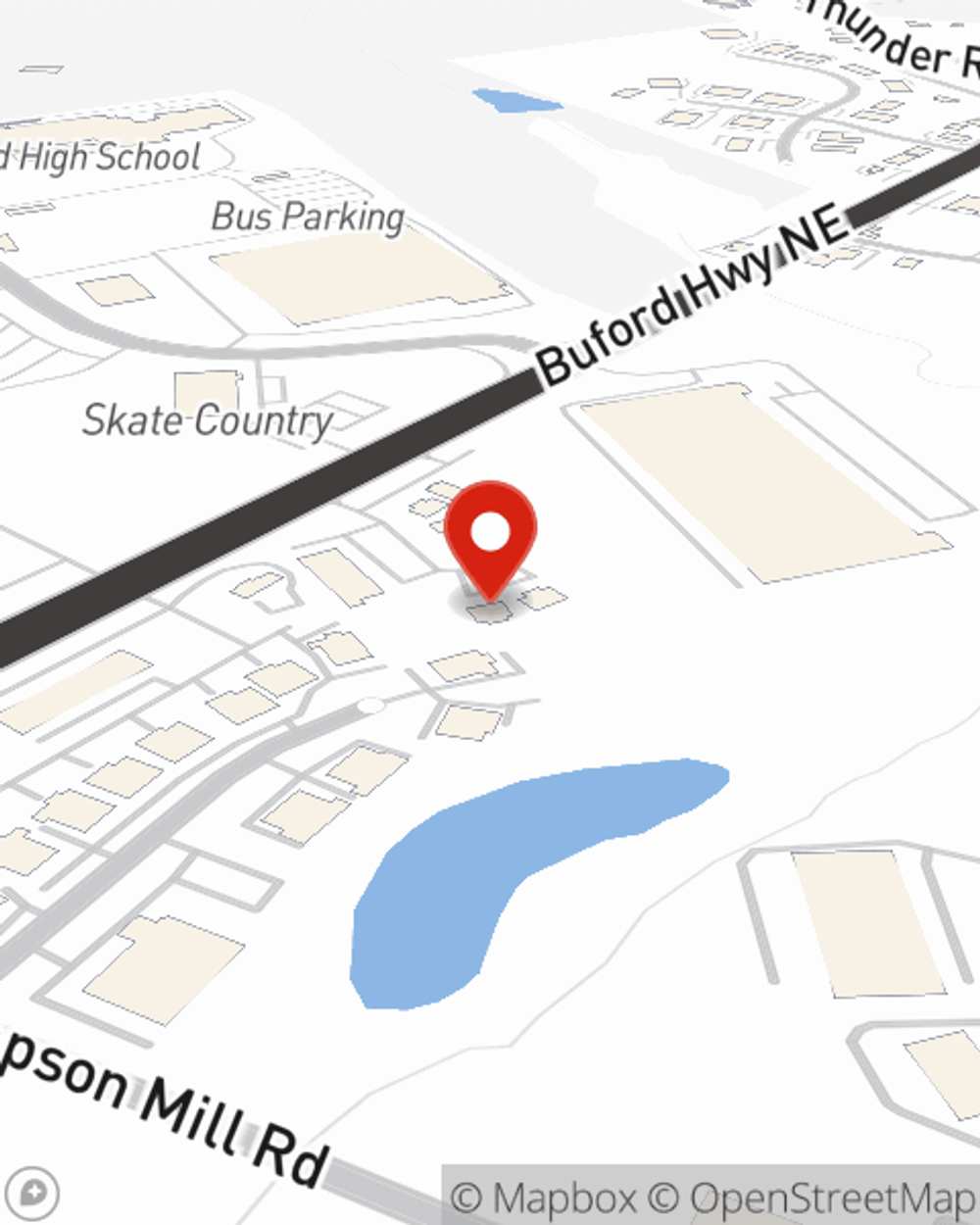

Business Insurance in and around Buford

Buford! Look no further for small business insurance.

This small business insurance is not risky

- Flowery Branch

- Dacula

- Sugar Hill

- Lawrenceville

- Oakwood

- Gainesville

- Auburn

- Winder

- Suwanee

- Braselton

- Hoschton

- Jefferson

- Athens

- Atlanta

Cost Effective Insurance For Your Business.

Whether you own a a cosmetic store, a photography business, or a hearing aid store, State Farm has small business protection that can help. That way, amid all the various moving pieces and options, you can focus on what matters most.

Buford! Look no further for small business insurance.

This small business insurance is not risky

Protect Your Future With State Farm

Your business thrives off your tenacity determination, and having outstanding coverage with State Farm. While you do what you love and lead your employees, let State Farm do their part in supporting you with artisan and service contractors policies, business owners policies and commercial liability umbrella policies.

As a small business owner as well, agent Kevin Cassidy understands that there is a lot on your plate. Reach out to Kevin Cassidy today to learn about your options.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Kevin Cassidy

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.